Monetary Donations

Check and Credit Card Donations

Check or bank draft donations can be mailed to:

Kirk Care, Inc.

P.O. Box 220652

Kirkwood, MO 63122

Credit card donations are secure using paypal: Visa, MasterCard or Discover cards are accepted.

Tax Exemption information:

Federal: 43-1331361

State: 12725579

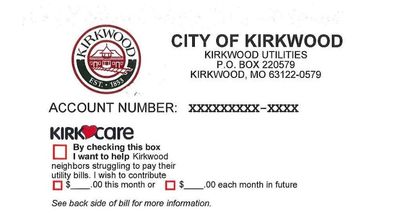

City of Kirkwood Utility Assistance

You can help our neighbors in need struggling to pay their utility bills by checking the Kirk Care box on your City of Kirkwood Utility Bill as a one time donation or a recurring donation.

Stock/Securities Donation

There may be tax advantage of donating appreciated stock to Kirk Care. The donor avoids having to pay capital gains tax when the donor sells the stock. In addition, the donor gets a tax deduction equal to the market value at the time the stock is donated.

To make a gift of stock, please advise your broker to direct the stock gift to benefit Kirk Care, Inc., Kirkwood, MO 63122 through our Wells Fargo account.

For added information, please send us an email or call us at 314-965-0406.

Corporate Matching Gifts

Your employer may match the amount of funds you donate to Kirk Care effectively doubling the assistance you provided to those in need within our community. Please contact your Human Resources Department to see if this is available.

Qualified Charitable Distributions

Required Minimum Distributions (RMDs) are required from Individual Retirement Accounts (IRAs) once an individual reaches the age of 70.5. There may be tax advantages of contributing all or a portion of the RMD to Kirk Care as a Qualified Charitable Distribution (QCD) to support our mission. Please contact your financial professional for details.

Food Pantry Tax Credit-Missouri Residents

For those individuals residing in Missouri, you may be eligible to receive a 50% Missouri Tax Credit for donations of cash and/or food to Kirk Care provided food pantry credit is approved in the budget by the State of Missouri. Currently potential credits of up to $2,500 for single filers or $5,000 for joint filers are available. We will provide upon request a pantry credit form including your annual donations to Kirk Care for you to include with your Missouri Income Tax filing to claim the credit.